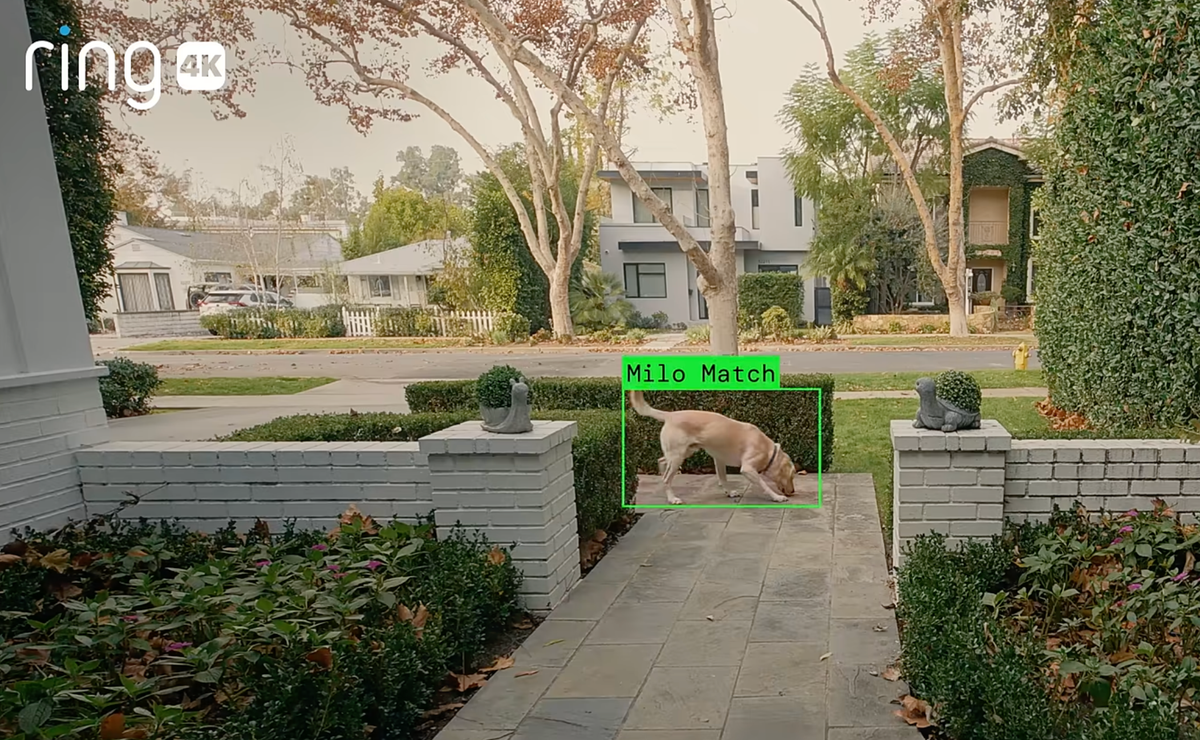

Ring used a Super Bowl ad to promote “Search Party,” an AI feature that leverages neighborhood Ring cameras to locate lost dogs, drawing sharp criticism from privacy experts who warn the tool can be repurposed for intrusive surveillance. The piece highlights Ring’s controversial history — police partnerships, past security lapses, and leadership turnover — signaling ongoing reputational and regulatory risk for the company (and its parent ecosystem) despite recent efforts to soften its public image.

Market structure: The Super Bowl ad re-centers Ring as a visible consumer-surveillance product and raises regulatory/PR friction that benefits privacy‑first device makers (expect AAPL, on‑device AI chip vendors) and enterprise surveillance/analytics firms that sell to governments (potential tailwind for PLTR). Direct losers are Ring's consumer hardware sales and Amazon's reputational capital in last‑mile services; expect a measurable demand dent of 3–8% in discretionary Ring unit sales over 3–6 months if negative coverage persists. Cross‑asset: AMZN equity IV should rise short‑term (+20–40% relative IV on headline risk), credit spreads could widen modestly (5–15 bps) only in a sustained regulatory escalation scenario. Risk assessment: Tail risks include a major data breach, FTC/European regulatory fines or state AG litigation that could force stricter police data‑sharing rules and a 10–20% hit to AMZN hardware/ads revenue bucket over 6–18 months. Timing: immediate reputational volatility (days–weeks), regulatory inquiries/hearings (1–6 months), legislative change or structural restrictions (6–24 months). Hidden dependency: Ring acts as a behavioral feed into Amazon’s ad and delivery ecosystem—attenuation there is a second‑order revenue risk not reflected in headline Ring unit figures. Catalysts: investigative reporting, FTC inquiries, Congressional hearings, or a consumer privacy class action within 30–90 days. Trade implications: Tactical protective hedges on AMZN are warranted rather than large outright shorts; expect short‑term 5–12% downside scenarios. Use put spreads to cap cost and buy volatility in the 1–3 month window; consider modest long exposure to AAPL (privacy halo) and conditional accumulation of PLTR if government contract flows accelerate. Sector tilt: trim consumer IoT/hardware exposure and rotate 2–4% into large‑cap software or on‑device AI chip names that benefit from decentralization of surveillance over 3–12 months. Contrarian angle: The market may overestimate structural damage to Amazon—AWS and retail are insulated, making very large short positions risky; recall Facebook post‑scandal recovery (Cambridge Analytica) where regulatory headline risk produced a multi‑month drawdown then re‑rating. Overreaction scenarios (AMZN >8–10% drop) create asymmetric buying opportunities; conversely, stricter regulation could accelerate enterprise spend on vetted surveillance analytics, benefiting PLTR over 6–18 months.

AI-powered research, real-time alerts, and portfolio analytics for institutional investors.

Request a DemoOverall Sentiment

moderately negative

Sentiment Score

-0.45

Ticker Sentiment