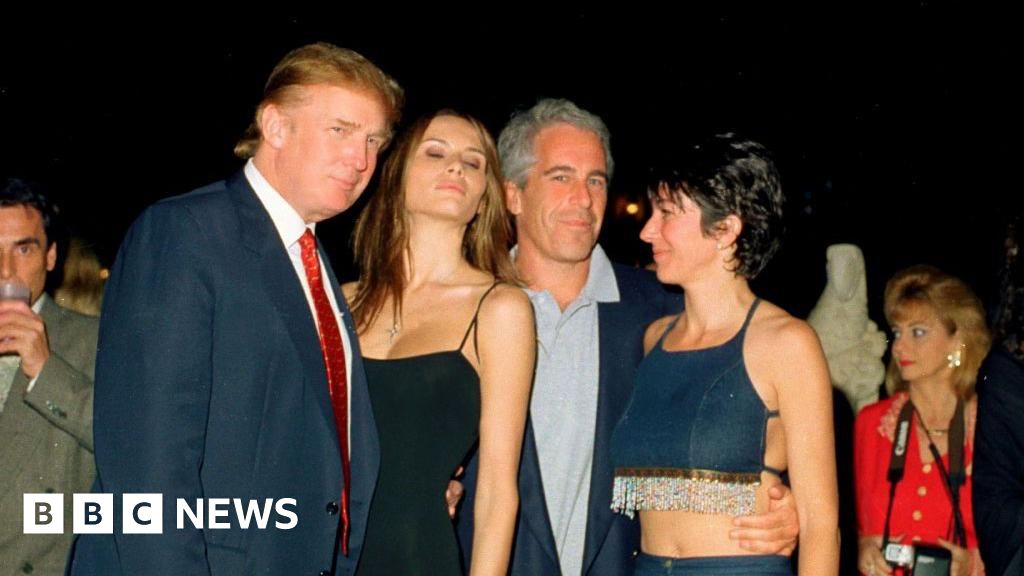

An FBI interview summary released in the latest Epstein files records that the then-Palm Beach police chief (identified as Michael Reiter) said Donald Trump called in July 2006 telling him 'everyone' knew about Jeffrey Epstein’s behavior, that Epstein had been thrown out of Mar-a-Lago, and that Ghislaine Maxwell was his 'operative.' The Department of Justice says it has no corroborating evidence of Trump contacting law enforcement; the White House offered equivocal comments. The disclosure adds political and legal risk narratives around Trump and key Epstein associates, though it is unlikely to have direct market implications.

Market structure: This is primarily a political/legal shock that redistributes short-term safe-haven flows rather than changing fundamentals. Expect modest inflows into large-cap defensives (consumer staples, utilities), sovereign bonds and gold within 24–72 hours; small-caps and consumer discretionary are the most vulnerable to sentiment-driven underperformance (-1% to -3% extra drawdown potential vs. S&P 500 in acute episodes). Risk assessment: Tail risks include a protracted legal cascade that materially shifts election odds or triggers policy uncertainty (low probability, high impact) — model a 4–8 week window where realized volatility could spike +30–70% from today’s baseline. Hidden dependencies: market reaction will track headlines and polling shifts, not legal merits, so correlation with media cycle and social sentiment is high; catalysts include new FBI/DOJ disclosures, congressional testimony, or pardon signals within 7–90 days. Trade implications: Favor small tactical hedges and defensive overlay versus large directional bets. Use 1–3% portfolio allocations in TLT/GLD/XLP for tail protection, consider VIX 30–90 day call spreads sized to 0.25–0.75% downside risk as a cost-effective hedge; implement pair trade long GLD (1–2%) vs. short UUP (0.5–1%) if dollar weakens >0.7% in 48 hours. Contrarian angles: The consensus will overprice headline risk into persistent volatility; historically (2016–2020) politically-driven scandals produced transient moves <3% in broad indices. If volatility normalizes in 2–6 weeks, fading aggressive hedges and rotating back into beaten-down cyclical exposure (small-cap value ETFs) offers asymmetric returns.

AI-powered research, real-time alerts, and portfolio analytics for institutional investors.

Request a DemoOverall Sentiment

mildly negative

Sentiment Score

-0.25