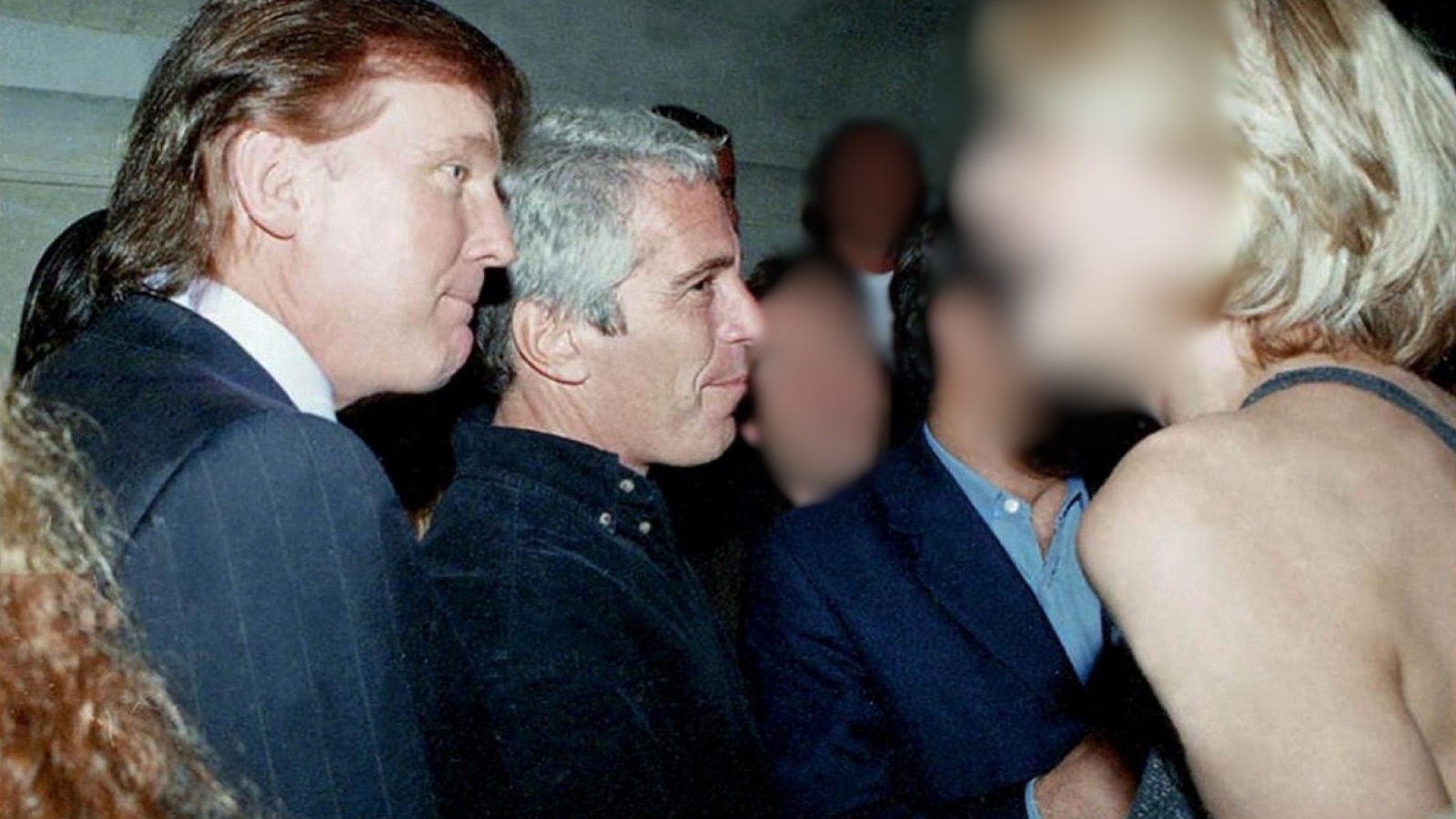

A 2019 FBI summary of an interview with former Palm Beach police chief Michael Reiter reports that Donald Trump called in July 2006 to thank Reiter for stopping Jeffrey Epstein and said 'everyone has known he's been doing this.' Reiter led the initial 2005 Florida probe into allegations Epstein recruited underage girls and later coordinated with federal authorities; the line of inquiry ultimately contributed to the controversial 2008 non-prosecution agreement. The account, newly reported from the FBI document, raises political and reputational risk but is unlikely to have material, direct market implications.

Market structure: This is a political/ legal-news shock that mechanically benefits media and short-term engagement-driven ad platforms (e.g., FOXA, CMCSA, META) while hurting sentiment-sensitive cyclical equities. Pricing power shifts are ephemeral — expect elevated ad CPMs and traffic for 1–8 weeks, not structural revenue re-rating. On cross-assets, risk-off knee-jerk: modest flight to quality (US 10Y rally of 10–30bp), USD strength and a 10–30% jump in near‑dated equity-implied volatility for headline-sensitive names. Risk assessment: Tail scenarios include a federal indictment or major DOJ filing within 0–90 days causing a 3–7% S&P gap and >=30bp move in 10Y; probability low but non-zero. Hidden dependencies: fundraising flows, primary calendars and related regulatory actions can amplify market moves; correlated liquidity crunches in small caps and political-donor-linked private assets are underrated. Catalysts to watch: DOJ filings, court docket updates, and major debate cycles in the next 30–120 days. Trade implications: Tactical hedges outperform directional exposure — buy short-dated insurance (30–45d) and small-duration bond protection. Media names can be traded for headline-driven alpha with tight stops; avoid large directional bets on election outcomes until legal events crystallize (30–90d). Options liquidity will widen around filings; favor liquid underlyings (SPY, VIX futures, TLT) for execution. Contrarian angles: Consensus treats each new allegation as prolonged political risk; history shows most high-profile news causes <10% market moves and mean-reverts in 2–8 weeks — look to add to quality cyclicals on >5% headline-driven selloffs. If aggregate implied vol (VIX) rises >25% and 30d realized stays <20%, purchase volatility carry via calendar spreads rather than outright long-term volatility exposure.

AI-powered research, real-time alerts, and portfolio analytics for institutional investors.

Request a DemoOverall Sentiment

moderately negative

Sentiment Score

-0.25